The commercial real estate market has been faced with headwinds for years, and 2024 may not be any different. With weak growth in the sector and a high interest rate environment that has pushed the cost of ownership to new heights, the CRE space is expected to continue falling in value this year.

In fact, property values could fall another 10% after falling 11% last year, according to Capital Economics’ deputy chief property economist Kiran Raichura. He sees growth softening “as the industrial rent boom gives way to more ‘normal’ growth rates and apartment rents flatline,” he wrote.

Using the firm’s estimation that the market size is more than $5 trillion, that means the 11% decline in value last year equaled roughly $590 billion, while the 10% fall expected in 2024 equates to $480 billion.

Capital Economics sees some areas being more distressed than other sectors, but overall, the entire commercial space is likely to face a turbulent year. And others in the real estate space seem to agree. Deloitte’s 2024 Global Real Estate Outlook Survey found that the highest percentage of respondents since 2018 expected the real estate sector’s conditions to worsen.

Where is CRE Headed in 2024?

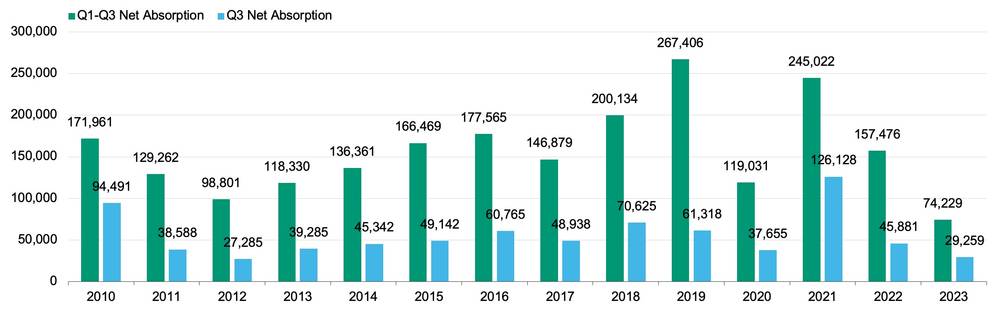

One area of commercial real estate that is expected to be hit the worst is, unsurprisingly, the office sector. This area of the real estate market has been struggling since the COVID-19 pandemic, with many companies downsizing their offices. Even with many larger firms pushing for workers to return to the office, workers have been reluctant to accept the return to five days a week in a cubicle, and it looks like remote work is here to stay. That’s bad news for office landlords looking to fill up vacancies, which rose to 19.2% in Q3 2023 nationally, according to Moody’s Analytics.

Raichura expects a 15% decline in office values due to falling revenues and rising capitalization rates (a property’s net operating income divided by the current market value). This could drive office vacancies even higher, which he expects to reach 20% by the end of 2025. This could further dampen revenue growth.

Multifamily properties like apartments are also likely to face headwinds in 2024, said Raichura. While rental prices started to level out last year, they remain high compared to overall disposable income. Coupled with an increase in multifamily housing that will likely lead to higher vacancies and put pressure on landlords already facing rising costs in a high interest rate environment, Capital Economics expects the property value of apartments to fall, with capital values falling 8.8% last year and 10.3% this year.

Some Bright Spots in the CRE Space

Still, it’s not all doom and gloom for the CRE space in 2024. Retail is a “bright spot,” Raichura wrote, predicting that it will have a total return of 6% annually over the next five years after first experiencing a cyclical slowdown.

In fact, retail is expected to be a “stalwart” this year and “is expected to experience steady performance, with unchanging vacancy rates and moderately positive rent growth for neighborhood and community shopping centers,” said Ermengarde Jabir, senior economist at Moody’s Analytics. There may even be opportunities for the office sector, such as converting office space into apartments or data centers, Jabir added.

Meanwhile, mortgage interest rates have already started to fall, and the Federal Reserve is expected to cut rates three times this year. This means lower borrowing costs for property owners looking to refinance, as well as lower overall costs for some landlords.

The Bottom Line

The commercial real estate sector is about to have another tumultuous year. CRE investors should be prepared to hunker down for a long time, as even the multifamily space could face headwinds. For real estate investors in the office space, now could be the time to start looking for other ways to make use of any vacant buildings.

Still, there may be some resilience in some areas of the market, like retail. And with interest rates declining this year, it could provide some much-needed relief to some landlords.

More from BiggerPockets: 2024 State of Real Estate Investing Report

After more than a decade of clearly favorable investing conditions, market dynamics have shifted. Conditions for investment are now more nuanced, and more uncertain. Download the 2024 State of Real Estate Investing report written by Dave Meyer, to find out which strategies and tactics are best suited to win in 2024.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.